In search of the best value brand new 4-bedders in Outside of Central Region (OCR), we look at what is available in the new launch market today, and compare them in terms of absolute prices. We chose to compare absolute prices because that is ultimately what matters to buyers, the total dollars and cents, rather than comparing per-square-foot price.

We have to keep the unit size within a reasonably small range, otherwise the smaller 4-bedders will unfairly rank top. To determine what is a suitable range, we look at what a standard 4-bedder size is in today’s new launch market. We find that most projects offering 4-bedders seem to agree on a size of 1,300 – 1,400 sqft. Therefore, we will be comparing brand new 4-bedders that fall within this size range.

The following table is based on live data that is updated daily, and has been sorted by lowest price first (going from left to right). Click on the button below if you want to find out more about each project, including its full price list, floor plans, factsheet etc.

Price Comparison

Sorted by lowest price first

Is price everything?

While a buyer may consider factors beyond price, it is unfortunately difficult to quantify qualitative factors such as location. We have nevertheless included a qualitative comparison in hope that it gives a better idea of the what some of these factors may be.

Our qualitative comparison includes the following:

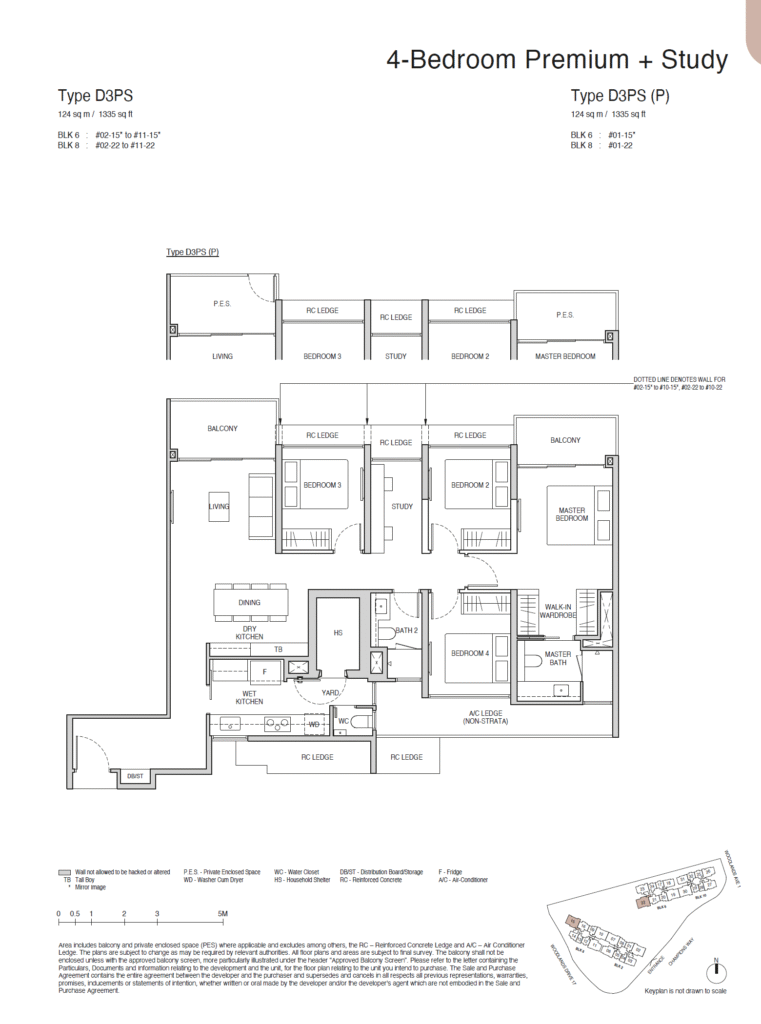

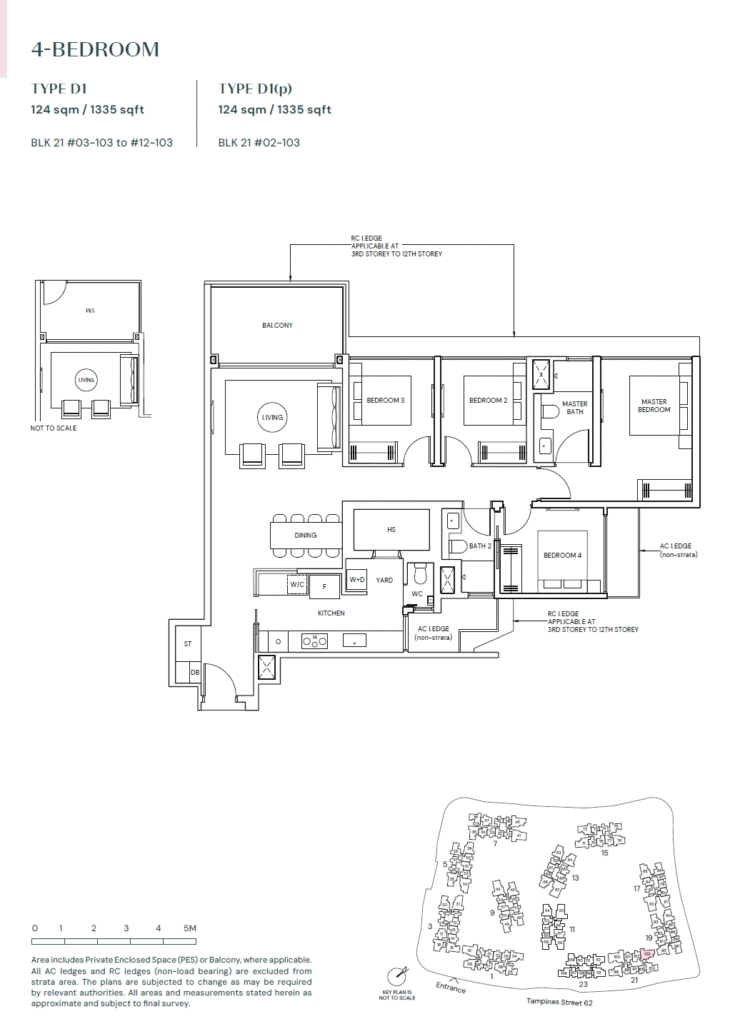

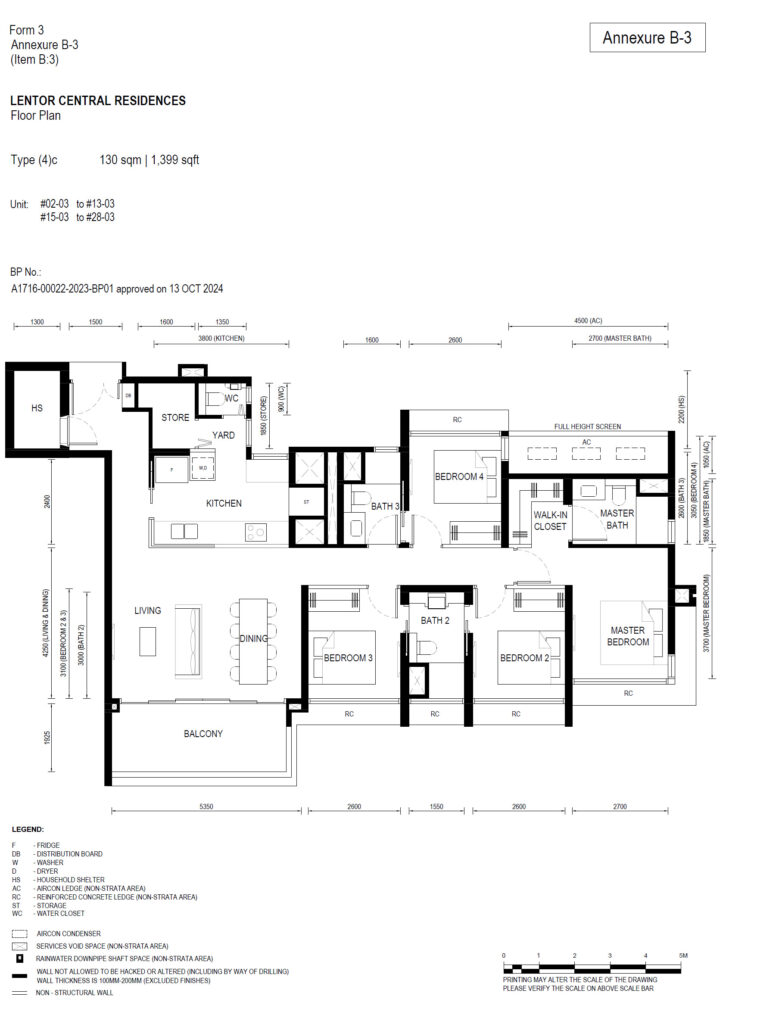

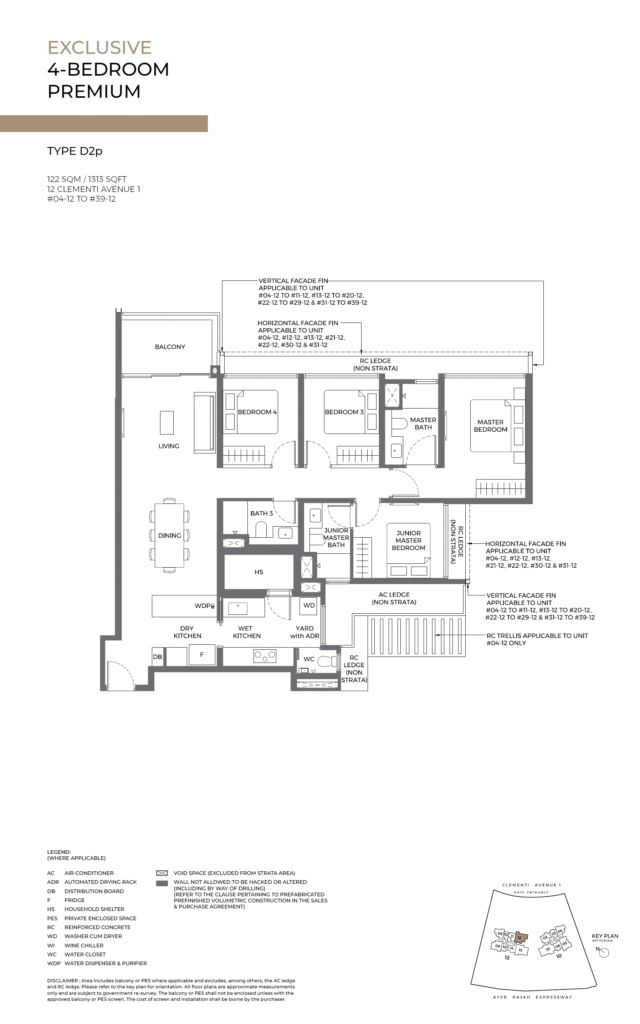

a) Floor Plan: This shows whether the layout of the unit itself is contributing to any price differences, for example having dead spaces. More importantly, it shows whether the layout is the right fit for buyers.

b) Distance to MRT: This gives a sense of whether the price includes a “convenience” premium. One would expect the nearer the project is to the MRT station, the higher the “convenience” premium, and that mixed-use projects integrated with MRT station should command the highest premium.

c) First day take-up rate: We think this is a good indicator of resale demand. If the project is able to attract demand during launch due to its attributes, the same attributes should attract demand when it enters the resale market, from buyers who want immediate occupation.

d) Resale supply within 1km: If there is a lack of supply, this can give assurance that when the project enters the resale market, the relatively lower prices of older properties in the area do not come into competition and take away some of the demand.

Qualitative Comparison

Norwood Grand

Location

Woodlands

Distance to MRT

250m to Woodlands South MRT

First day take up rate

84%

Resale supply within 1km

Freehold = 0

99 Years = 2,794 units

Total = 2,794 units

Key Points

- Developer CDL has 60 years of proven track record

- First launch in Woodlands since 2012

- Notable facilities include Treetop Walk, a Grand Club & Tennis Court

- Short walk to Woodlands South MRT

- Close proximity to the future largest economic hub in the North: Woodlands Regional Centre, Northern Agri-Tech and Food Corridor & Woodlands Health Campus

Parktown Residence

Location

Tampines

Distance to MRT

50m to Tampines North MRT

First day take up rate

87%

Resale supply within 1km

Freehold - 453 units

99 Years - 6,466 units

Total - 6,919 units

Key Points

- Developer comprises 3 of Singapore’s most esteemed developers, namely UOL, CapitaLand & SingLand.

- Tampines’ first fully integrated development

- Comprises Residential, Retail Mall, Transport Hub (MRT & Bus Interchange), Community Club, Community Plaza & Hawker Centre

- Fully integrated developments account for below 2% of total supply

Lentor Central Residences

Location

Lentor

Distance to MRT

300m to Lentor MRT

First day take up rate

93%

Resale supply within 1km

Freehold - 1,488 units

99 Years - 3,327 units

Total - 4,815 units

Key Points

- Developed by award-winning Guocoland who is playing the “master developer” role at transforming Lentor

- Ideally located near Lentor MRT & future Lentor Mall

- Near good primary schools such as Anderson Primary School and CHIJ St Nicholas Girls School

- Notable facilities include the Floating Clubhouse

- Connect to nature, 7.6ha park at Teachers Estate

Elta

Location

Clementi

Distance to MRT

700m to Clementi MRT

First day take up rate

65%

Resale supply within 1km

Freehold - 659 units

99 Years - 1,463 units

Total - 2,122 units

Key Points

- Developed by 2 established developers MCL Land & CSC Land

- Clementi is a sought-after address in the western part of Singapore

- No new launches in the last 4 years

- Unobstructed view towards the north and south

- Provision of shuttle bus to Clementi MRT Station

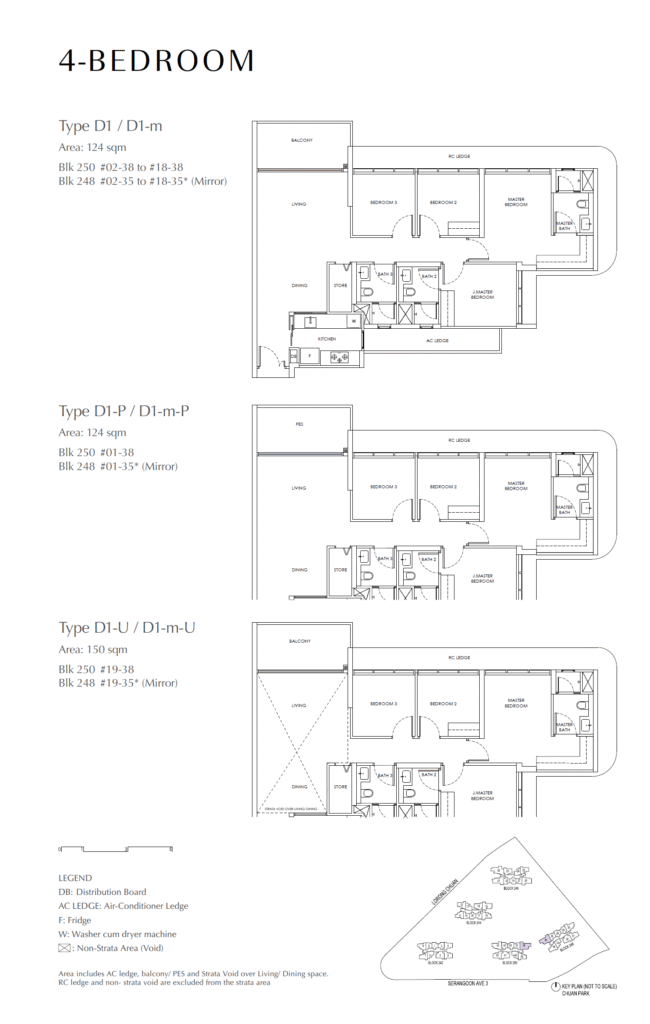

Chuan Park

Location

Serangoon

Distance to MRT

50m to Lorong Chuan MRT

First day take up rate

76%

Resale supply within 1km

Freehold - 993 units

99 Years - 2,048 units

Total - 3,041 units

Key Points

- Located right next to Lorong Chuan MRT

- Offers panoramic views of its surrounding

- First new launch in 14 years in Lorong Chuan area

- Large land size with lush landscapes and generous amount of facilities